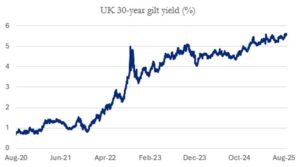

UK long-term borrowing costs have surged to their highest levels since the late 1990s, with 30-year gilt yields briefly touching 5.64% before easing to 5.6%, driven by global bond market pressures, Donald Trump’s clashes with the US Federal Reserve, and concerns over the UK’s fragile economic outlook.

Analysts warn the UK faces a fiscal trap of weak growth, high taxes, and persistent deficits, with Capital Economics estimating that rising yields could slash chancellor Rachel Reeves’ fiscal headroom from £9.9bn to £5.3bn and potentially force up to £27bn in new tax measures or spending cuts. The gilt sell-off has been sharper than in German Bunds or US Treasuries, fuelling fears of stagflation as inflation hovers just under 4%, constraining the Bank of England’s ability to cut rates.

At the same time, the BoE’s £100bn-a-year quantitative tightening programme is under scrutiny, with investors cautioning that bond sales are depressing prices and undermining market stability. While 10-year yields remain below January’s highs, the combination of fiscal stress, inflation concerns, and policy credibility questions has left gilts underperforming peers, with investors warning of risks of a “market tantrum” unless the government reins in spending or the BoE slows QT. Meanwhile, the pound has firmed against the dollar, but derivatives markets show traders now expect only one BoE rate cut over the next year, compared with four for the Fed.